UK Momentum Cools, Eurozone Steadies, and Fed Hawks Slow Markets

- Blake Reddy

- Sep 27, 2025

- 3 min read

Markets remain caught between resilient economic data and cautious central banks. While growth signals persist, policymakers on both sides of the Atlantic are signalling that rate cuts will be gradual and conditional, keeping volatility alive.

This week we look first at the UK, where activity slowed in September, before turning to the eurozone’s modest rebound, and the Federal Reserve’s latest communications.

UK - Growth pulse fades ahead of November budget

After a summer uptick, the UK’s business activity has slowed again. The September PMI survey fell to 51.0, down from August’s 12-month high of 53.5. Services momentum cooled and manufacturing output contracted at its fastest pace since March, weighed down partly by disruption in the auto sector.

Business confidence has slipped to its lowest since June, reflecting uncertainty around November’s budget. With the government committed to fiscal restraint, investors are increasingly wary of the growth outlook heading into 2025.

Equities were firmer, with the FTSE 100 gaining 0.7% on the week, though much of that strength came from energy stocks buoyed by rising oil prices. Sterling was steady, helped by broad US dollar softness earlier in the week but vulnerable to downside if growth signals weaken further.

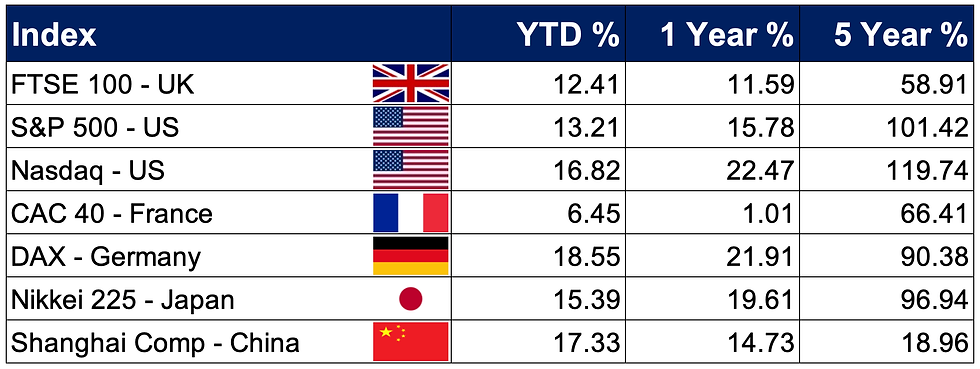

Where Is Your Pension Invested?

Europe - Services drive resilience, politics remain a drag

The eurozone’s September PMI data painted a more positive picture. The composite index rose to 51.2, its highest in 16 months, driven by services activity. Manufacturing, however, continues to lag, and overall business confidence dipped to a four-month low on weaker factory sentiment.

Germany’s outlook remains fragile. The Ifo Institute reported a sharp fall in business sentiment, though consumer surveys showed households slightly less pessimistic as income expectations improved.

Elsewhere, monetary policy divergence was on show. Sweden’s Riksbank cut its policy rate for the third time this year, to 1.75%, while Switzerland’s central bank kept rates at 0%, confident that inflation at 0.2% is back in its comfort zone. These moves highlight a broader European theme: while the ECB has paused, smaller central banks are moving faster to support growth.

United States - Hawkish Fed tone tempers optimism

US equities slipped last week as Federal Reserve officials struck a more cautious note on rate cuts. The Nasdaq led declines, down 0.65%, while small-caps posted their first weekly loss since early August. Energy stocks were an exception, rallying on oil’s surge following US pressure on the EU to curtail Russian imports.

Fed Chair Jerome Powell described the economy as in a “challenging situation,” citing upside inflation risks alongside downside labour market concerns. He also warned that equity valuations look stretched. Several other policymakers echoed his caution, dampening expectations for rapid easing.

The Fed’s preferred inflation gauge, core PCE, rose 0.2% in August - unchanged from July - putting annual inflation at 2.9%. GDP was revised higher, with Q2 growth now estimated at 3.8% annualised, up from 3.3%, thanks to stronger consumer spending.

The housing market showed mixed signals: new home sales surged to their highest since early 2022, while existing home sales were broadly flat. Treasury yields rose at the short end of the curve, reflecting diminished rate cut expectations, while longer maturities were little changed.

What It Means for You

For UK private investors, three themes dominate this week’s picture:

Domestic growth is fragile. The UK’s recovery remains shallow, and confidence is falling ahead of November’s budget. This leaves sterling vulnerable and argues for measured exposure to UK equities.

Europe is showing selective resilience. Services are holding up, but manufacturing remains a drag. Policy divergence across smaller central banks highlights the need for selectivity across the region.

The Fed’s caution keeps volatility alive. Inflation is moderating, but policymakers are reluctant to cut too quickly. Short-term yields have risen, equities have softened, and valuations remain a concern.

The broader message is that while inflation has moderated globally, central banks are signalling a slow and cautious path ahead. For investors, maintaining global diversification, balancing equity exposure with quality fixed income, and staying disciplined remains the best defence in an uncertain environment.

.png)

Comments